For Deanna, living 50 + years in one home does not just accumulate memories, but forges a lifeline that connects her past and present.

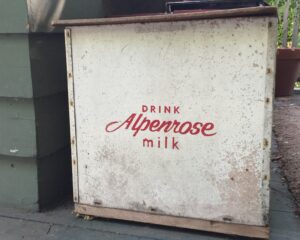

An Alpenrose Dairy box on the front porch of a home in Portland is a sign from a time that has long passed. Cottage cheese, sour cream, and (my personal favorite as a kid) chocolate milk! were delivered to your home every week. For Deanna, living 50 + years in one home does not just accumulate memories, but forges a lifeline that connects her past and present.

At age 85, she will tell you she has spent time in assisted living and nursing home care. People have been kind everywhere, but there is no place like home. Deanna is extremely happy to have figured how how to manage the cost of in-home care and to be back among her books, figurines and roses.

The Financial Challenge:

Financially, assistance for Deanna’s activities of daily living (ADL) is high. Her in-home care from a well-known and very reputable care service is approximately $9,500 per month. She is on a fixed income and her assets are in the equity of her home. Her property tax deferment had reached its limit. Her choices were to sell, move full time to nursing care AND manage her finances so that they would last for the remainder of her lifetime, or to consider a Reverse Mortgage to fund her in-home care.

The Solution:

Today Deanna is in her home with daily assistance. And, instead of being worried about cash-flow, she is looking forward to creating her annual holiday sachet gifts from dried rose petals collected from her garden. A Reverse Mortgage from Kim Dodge was closed within 35 days and loan funds were able to pay off the deferred property taxes and provide a large line of credit for monthly draws to pay for the in-home care that keeps Deanna healthy, safe, happy AND AT HOME! More info about FHA Reverse Mortgage.

What to Do?

The strategic use of home equity is being recommended by The American College of Financial Services as a financial planning solution that can help a person’s money last further in retirement. A HECM (Home Equity Conversion Mortgage) or Reverse Mortgage is not right for everyone. Seniors must qualify, but that is where our team comes in. We inform you of all your home financing options, evaluate any other loan types we think could benefit you, make recommendations and will talk to your family members and financial advisor if you want us to. We process the loan, keep you informed and are there for you every step. After the loan is closed we are there to make sure you are fully able to use all the flexibility and benefits this loan can provide you. Local, experienced, lender for life!

Learn About Your Options, Be Retirement Ready!

Phone: (503) 595-1600 or Email: Hello@KimDodgeReverse.com

Kim Dodge, Branch Manager | NMLS 186099

Cheryl Teigen, Loan Officer | NMLS 2089085

Kim Dodge Reverse Mortgage, a dba of Zyng, Inc.

NMLS 76801 | Licensed in Oregon & Washington

ConsumerAccess.org

Kim Dodge Reverse Mortgage – YouTube